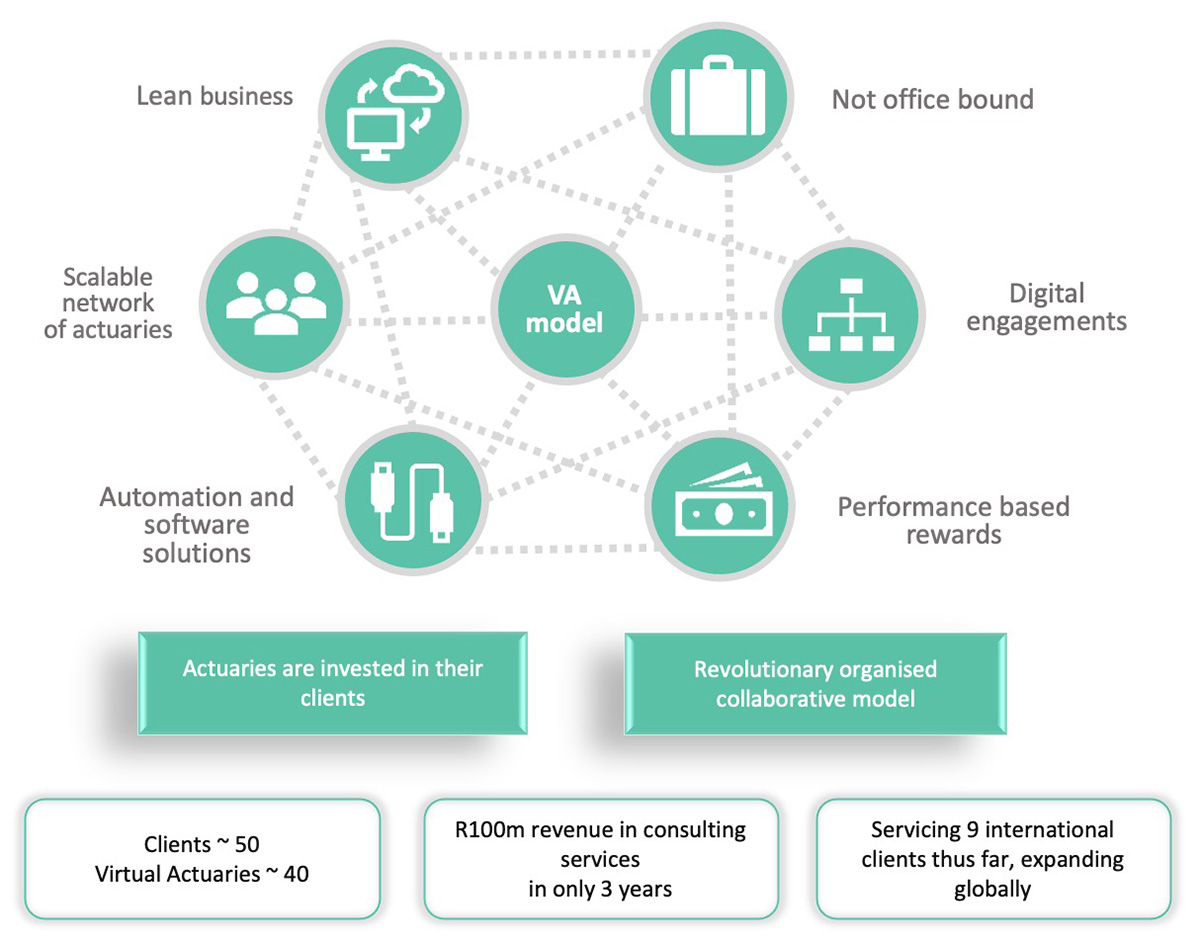

Virtual Actuary (VA) has developed a new successful concept for delivering actuarial services to clients

- VA can match or exceed quality levels of existing consultancies without incurring costs and obligations inherent with fixed staff.

Quality assurance at the forefront of priorities

- Operational team responsible for diligent scoping of projects and matching best staff to client requirements

- Strict and controlled peer review system

- Staff leverage a global knowledge and experience base for support

- Seasoned project and delivery managers put in place where required

- Monthly feedback sessions with clients by directors.

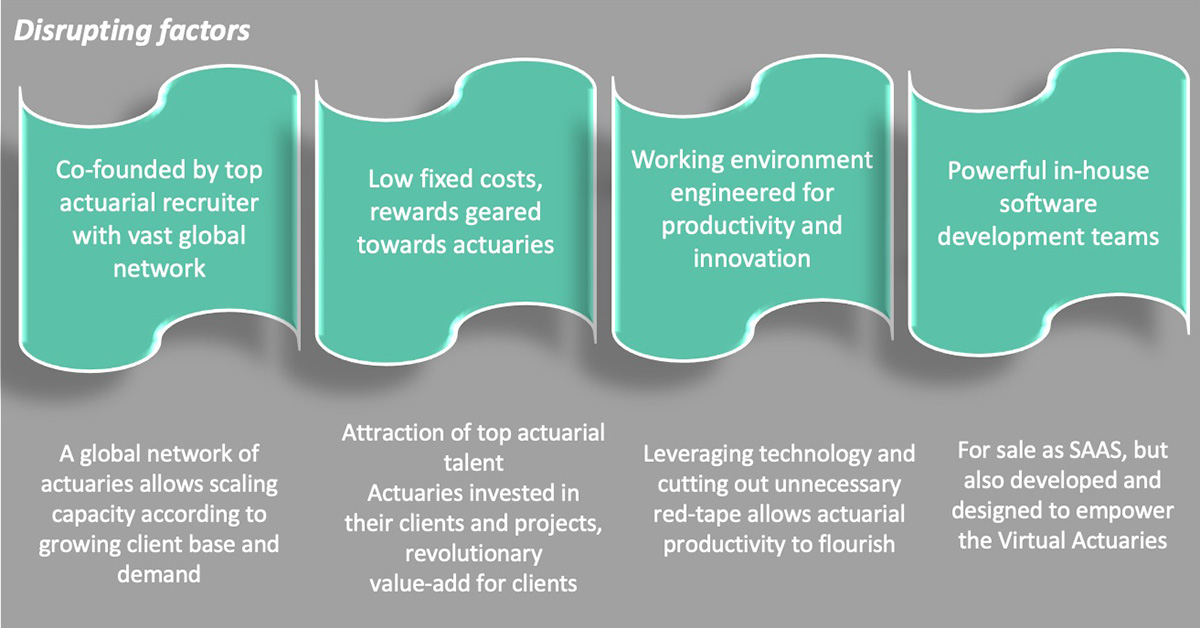

Actuarial industry has traditionally been slow to change

- Inhouse actuaries utilising legacy systems which are slow and cumbersome

- Traditional consulting businesses with high earning partners at the top and lower level actuaries working long hours

New technology enables actuaries to perform their services independently and offsite

- With clients under pressure to reduce costs, leading to reduced actuarial departments

- Global shortage of actuaries means a new Virtual workforce of actuaries is the future.

Consulting Services

Traditional actuarial consulting

Life Insurance, General Insurance, Banking, Healthcare, Investments, Reinsurance

Multi Manager Investments consulting

Servicing investment clients

Insurtech SAAS

Remote Software as a Service actuarial consulting

Revolutionary Business Model

Main Insurance Services

- Optimisation of customer retention strategies and value propositions or other related analytics service to enhance business value

- Designing and implementation of digitally fulfilled insurance products and operational platforms

- Actuarial experience analyses and development of management information dashboards for KPIs

- Product development and pricing support, including end-to-end product roll-out to market

- Broad range of financial and statutory actuarial reporting services

- End-to-end IFRS 17 consulting and implementation services

- Backfilling for permanent staff at clients due to temporary vacancies, high strategic project demands, maternity leave, etc.

- Management and training responsibilities of junior staff

- Managing and resourcing a completely outsourced actuarial function

- Independent model validation services, including various internal audit support

- Actuarial model modernisation and/or migration to new modelling software

- Modernisation and/or automation of various functions and processes around actuarial models, accounting sources and financial and statutory reporting